Helping HR prepare for the post-merger integration challenge

Seven top priorities for the HR team to prepare for a company takeover.

Someone once said that everything stops during a takeover, as people speculate on the direction of the fall of the axe. The sudden techtonic shift reminds us that companies are put together as human constructs and can quickly be remade. Our Finance Director Patrick Gracey has previously blogged on how to improve your chances of acquisition success. But in this blog, I want to focus on what the HR team in particular can do to prepare.

HR Help urgently!

We have been contacted by the HR teams of several companies that are the targets for corporate transactions. They want to get themselves ready. They cannot afford to wait around. What are forward-thinking HR professionals doing to get ready? Here are seven items that have been a priority for them:

- Map your data

- Get the As-Is clear

- Review the project list

- Clarify top talent

- Map risks

- Identify areas of overlap

- Reach out to the future HR team

Seven top priorities for ‘target company’ HR team:

1. Map your data

The acquiring organisation will soon arrive with requests for existing data. Before they arrive, it’s worth documenting data sources, data owners and data quality. One recent client had more than 40 HR data sources across more than 20 countries. Another client had highly fragmented hierarchies, with 95% of its staff either orphans (line manager not listed or not identified in existing database) or in orphan groups (disconnected from the main org structure). Preparing a document listing data sources, owners and data quality prepares you for conversations about next steps.

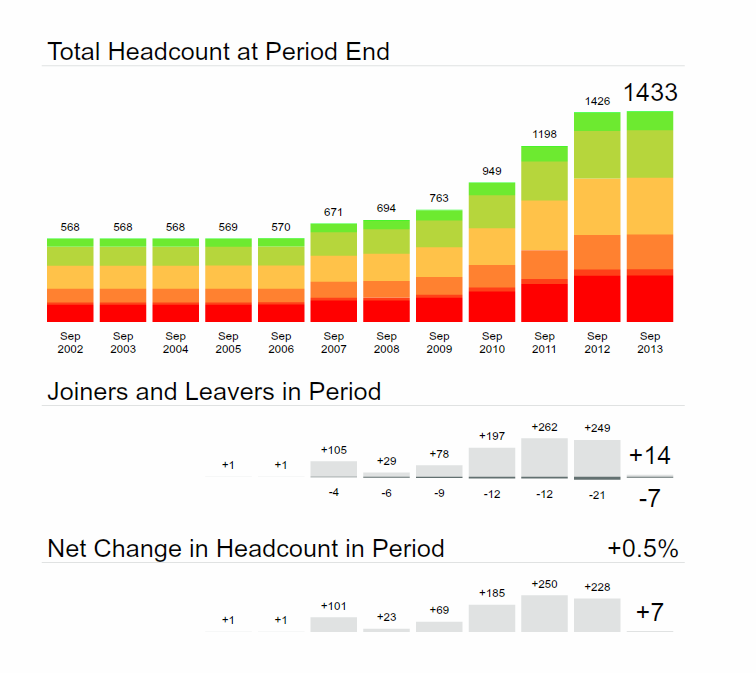

2. Get the As-Is clear

The core data needs to be ready. Prepare existing org charts and an existing headcount report. Reach out internally to get alignment with Finance data. Check Finance’s current numbers for heads employed per department and region and cross map against what the HRMIS currently shows. You are likely to need a data reconciliation meeting to identify and quantify any differences and to understand and explain why they arise. Is it definitions – FTE? Heads? Is it different monthly cycles for collecting data? Is it data errors or incompleteness, and if so, can HR and Finance agree what the sources of truth are? Having one view of the data will keep HR in the room when post-merger integration discussions are happening.

3. Review the project list

What projects are currently being worked on, both in the HR department and in the wider organisation? How much time has been allocated to them, what are their objectives and budgets? Are they on track or not? Who is the person responsible for each one? What is the strategic importance attached to each one? How does strategic importance of each project translate criticality of delivery and workload for each person responsible? If possible, merge performance data to compare the strategic importance of the portfolio allocated to each person vs. their documented ability to deliver.

4. Map risks

What are the major HR risk areas facing the business? Examples can include:

- Contractors who have been in place more than 2 years

- Contractor vs. permanent mix

- Retirement risk

- Current attrition levels

- Discrimination cases due to differential pay

What existing analyses are there in each area? What actions will need to be taken in all these areas in the first 6 months after a takeover?

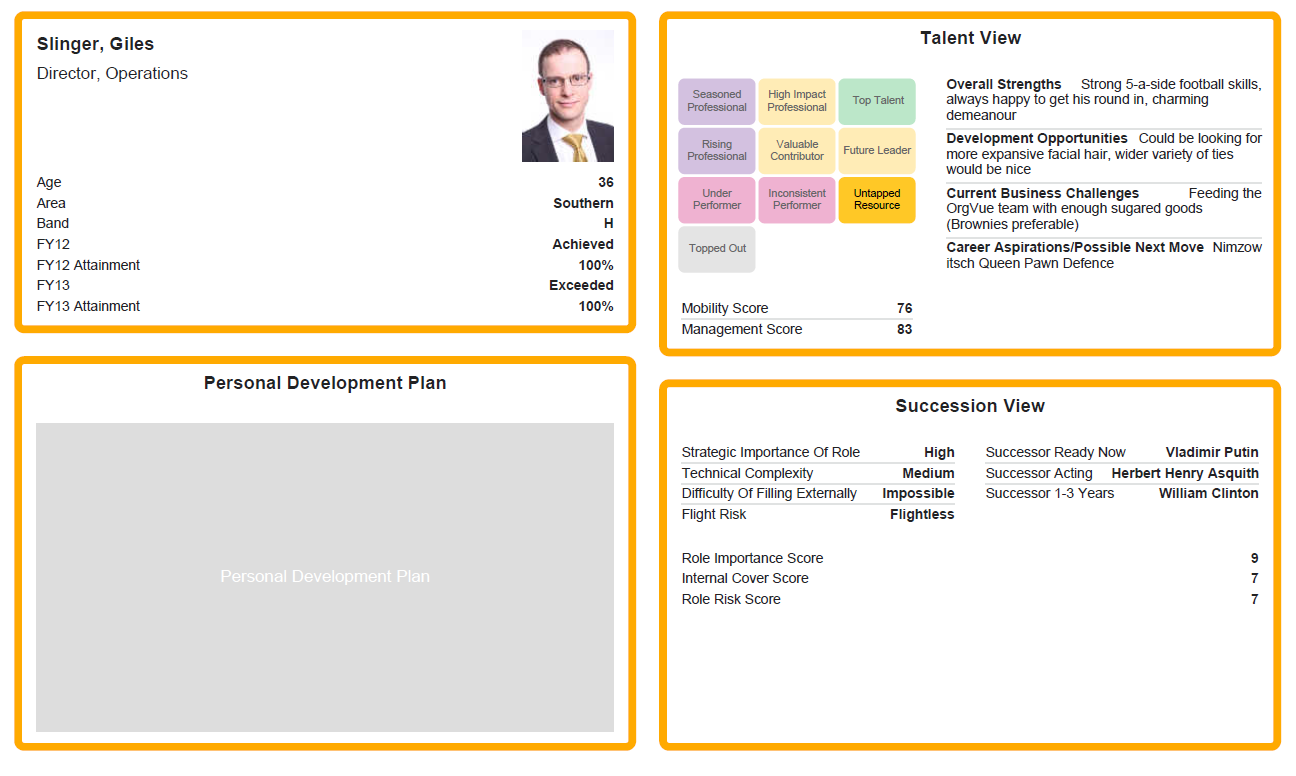

5. Clarify top talent

A few questions zoom in on the issues after a takeover.

- What are the key risk roles in each area?

- Who is the top talent in the organisation?

- What percentage of each area is identified as talent?

- What are the flight risks associated with each person?

For a recent client, we have assembled a 1-pager on succession. Critically, it didn’t require a new system for the organisation – it just sat on top, gathered and presented data that already existed. Our developers had some fun with the content in this example, but the principles and layout are useful to share. This 1-pager is used to bring together information about the person and the role so that the HR and management team can review the Talent team by team, and check for succession issues.

6. Identify areas of overlap

If data can be obtained, it is very powerful to take a view of the acquirer.

- How is the acquiring business structured?

- What activities does it have?

- What likely areas of overlap are there?

- What corporate functions are likely to be duplicated (HR, Finance, Marketing, IT, Corporate Office); what business functions are likely to overlap (Sales, Production, R&D, Logistics?)

- Pay differences with acquiring organisation

- Potential impact of site changes

It is worth creating a first view of the other party, so that the organisation can start to prepare. In advance of any deal, good sources of data for this could include org charts published publicly and annual reports. After a deal has happened, or has been made public, you may be able to contact the internal (or the acquiring) deal team for information.

7. Reach out to the future HR team

It’s not always easy to do, but reaching out makes sense every time. Who are the key people in the acquiring organisation? These are your future colleagues. Obviously you will leverage any existing contacts and connections through the well-established networks of the HR world. It may also be worth setting up an informal get-to-know-you occasion for the HR leads, the senior HR teams and then the entire central HR function. Change is guaranteed and it would be sensible to have the key implementers of that change on side with each other from the start. Who knows, it might save your and your colleagues’ jobs…

Have you been in an HR team waiting to be acquired? Let us know your experience – we would be pleased to publish guest views on how to make the best of the time available leading up to acquisition.