Fundamental challenges in M&A

As the business environment undergoes dramatic changes, leaders across various sectors view mergers and acquisitions (M&A) as an increasingly crucial strategic tool. However, data shows 60% of M&A deals do not deliver promised value. So how do you make sure that yours falls into the 40% that succeed?

Many deals fail due to:

- Lack of in-house capability and resources

- Poor planning or lack of a disciplined integration approach

- Inaccurate data and an inability to effectively report against plans

- Tracking value as responsibility in the business shifts

With the coming boost in M&As activity, are you prepared to meet new demands, and manage these obstacles to ensure your deal delivers the value it promises?

Harmonization of data

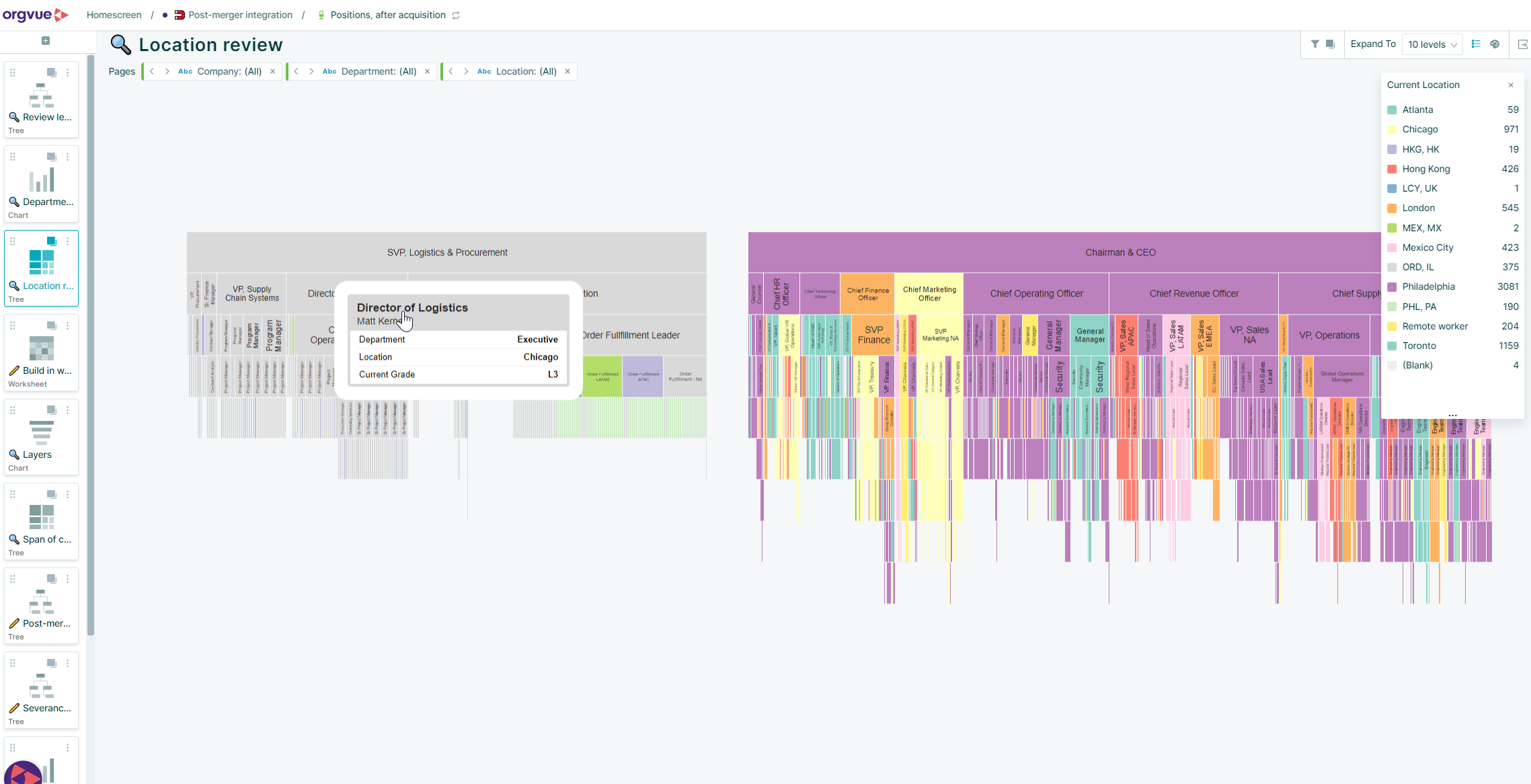

Challenge 1: Quickly understanding the structure and assets of the company being acquired after the deal closes.

You can solve this problem by creating greater transparency with workforce data that enables conversations between leaders on both sides. You do this by representing data in ways that accelerate alignment and reveal opportunities for synergies and optimization.

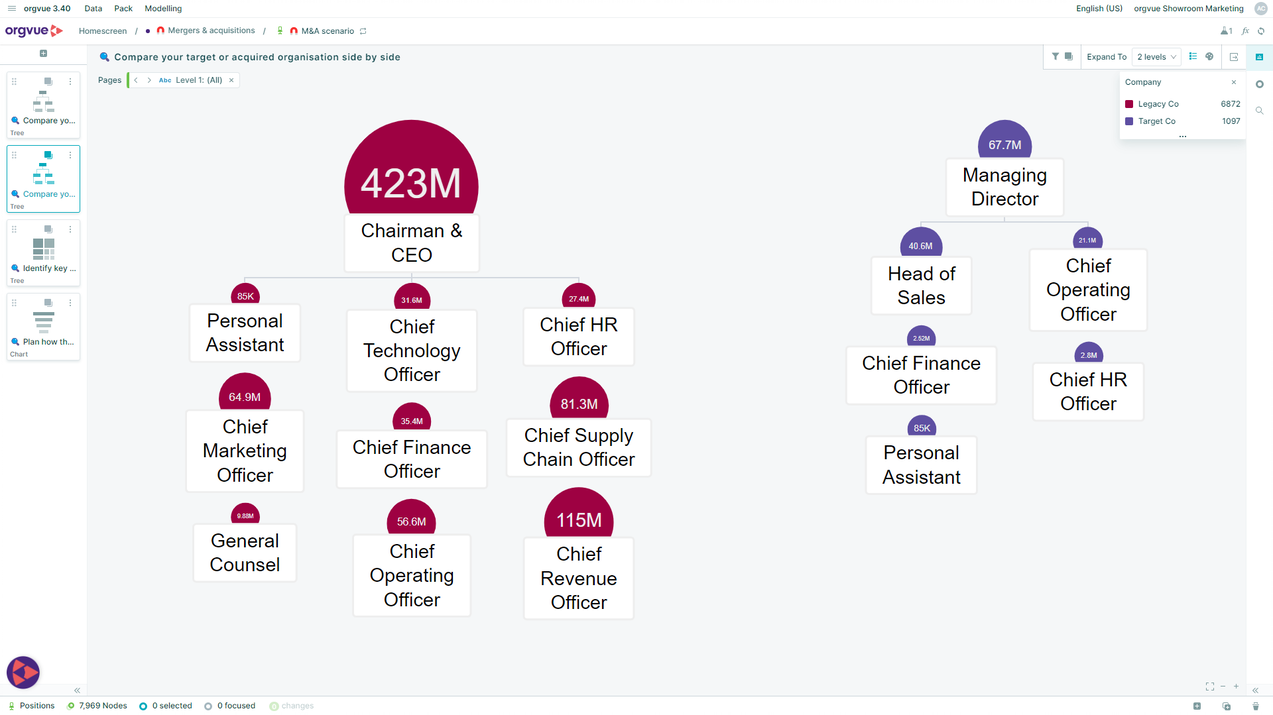

Integration modeling

Challenge 2: Many teams working with different data sources (Finance, HR, Operations) leads to confusion.

Orgvue helps by creating virtual deal rooms with a secure, single source of harmonized data, which can be accessed by these teams to foster collaboration on modeling the future organization.

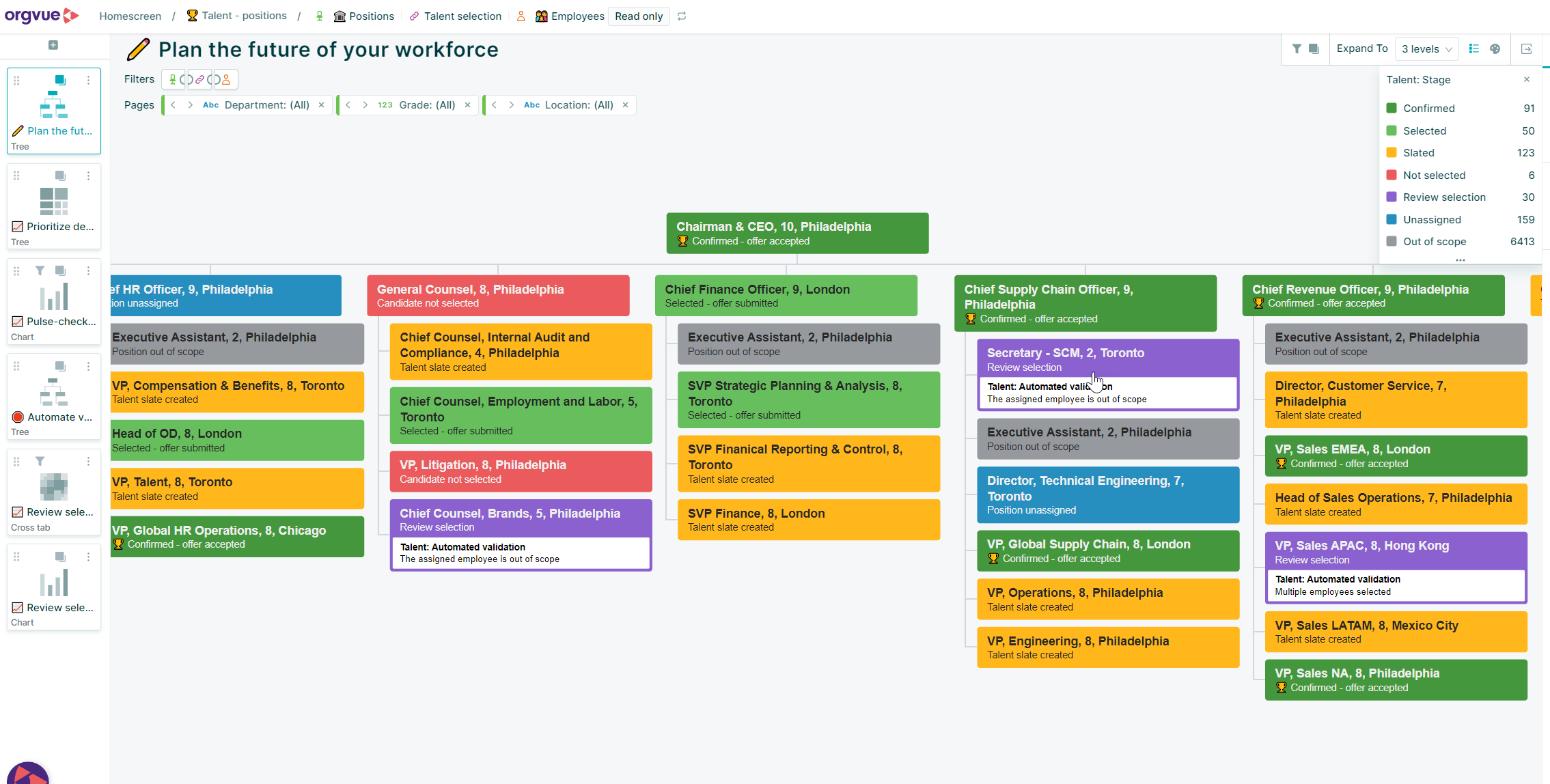

Talent selection

Challenge 3: Mapping thousands of employees to thousands of different roles is a tough challenge, especially when there’s a lack of understanding of what the critical roles and responsibilities are.

Orgvue helps planners make informed decisions based on criteria such as skills, financial planning, regulatory compliance and, more recently, hybrid working.

5 steps to success with the Orgvue solution

Orgvue supports M&A integrations by enabling organizations to think and act quickly. It consolidates various data sources to reveal the true state of your organization and the companies you acquire. This allows Business, Finance, and HR stakeholders to collaborate on the same datasets, work together on future-state design, and monitor the effectiveness of execution.

Due diligence, data cleaning and harmonization

- Combine data from multiple systems, such as your HR and Finance platforms.

- Create a secure, segregated data workspace to analyze, clean and model large volumes of data quickly.

- Establish a like-for-like comparison across both companies and identify focus areas for synergies.

- Mitigate risk by revealing early detail on the impact your planning will have across the new organization.

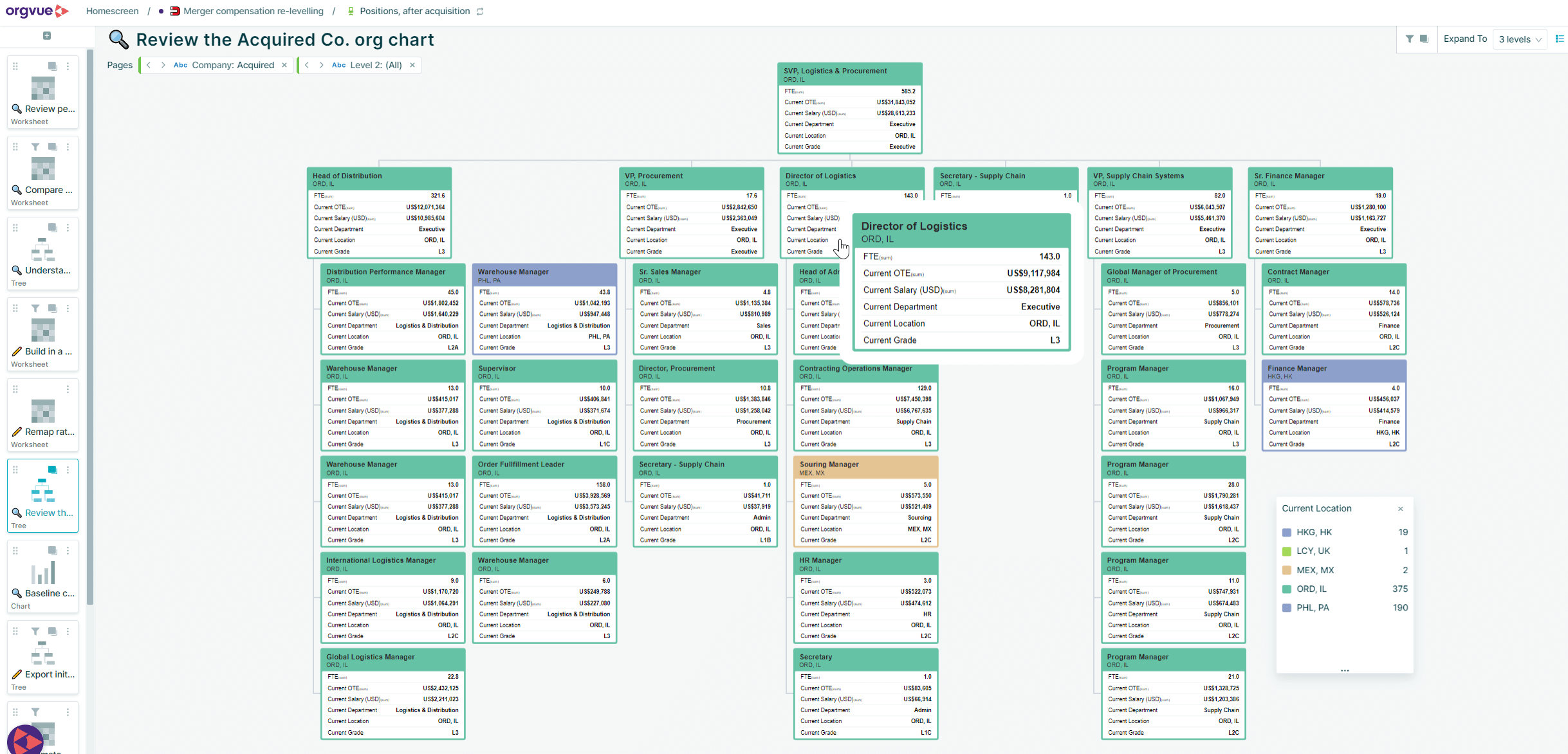

Mapping and leveling

- Compare job grades and compensation.

- Automate mapping and leveling recommendations across both organizations.

- Reconcile titles, departments and other integration elements.

- Run alignment checks to understand changes in on-target earnings, compa-ratios and other compensation metrics.

Integration planning

- Establish ‘Day 1’ structure, model changes and see the ‘before’ and ‘after’ implications on key metrics like cost and headcount.

- Visualize the combined organizational structure in compliance with organizational design principles, regulatory requirements and audit trails.

- Integrate synergy planning with financial planning, so you can identify and track benefits.

Talent selection

- Place current talent into future-state positions that have been modeled in Orgvue.

- Visualize the status of each employee and position by linking these datasets to reveal progress, gaps and risk in the talent selection process.

- Track and audit talent placement decisions.

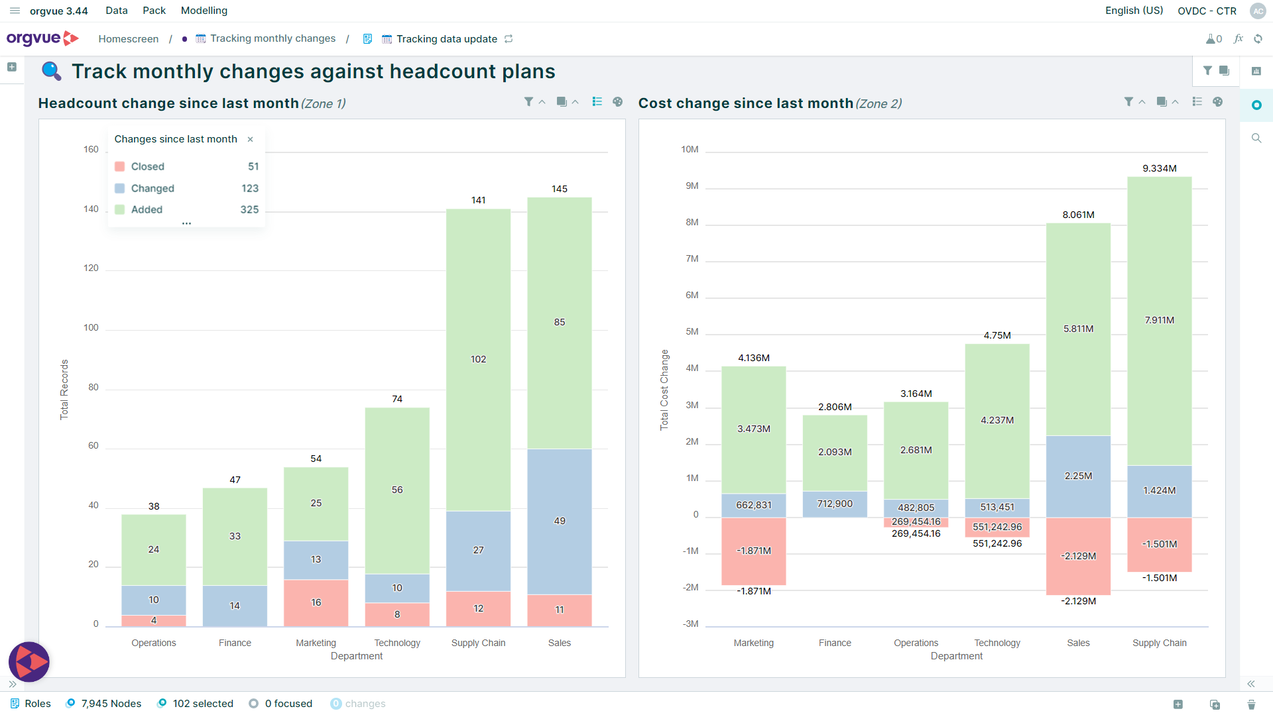

Synergy tracking and monitoring

- Convert designs into monthly forecasts.

- Track changes to headcount and cost over time.

- Compare with original assumptions, targets and commitments.

- See progress against targets by line of business and leader.

Customer story

An accelerated integration of two global media companies

200k+

Employees

200k+ employees assessed and re-deployed in the process

60+

Upskilled employees

60+ upskilled internal employees to run the process

The process was complex, mostly because of the large volume of data and the sheer number of stakeholders involved… but we managed to get it done quickly, securely and risk-free.

VP, Organizational Design

Business goal

- Successfully merge two of the largest global media companies following a $70bn acquisition.

- Build the new organizational structure and move to the new model, while minimizing cost and reliance on third parties.

Solution

- Integrated and centralized data from both businesses securely in Orgvue.

- Built the new organizational design and moved more than 200,000 employees into positions based on their skills and competencies.

- Set up a standardized rollout process across globally distributed HR teams.

- Trained a center of excellence team of more than 60 people to manage the process and monitor progress.

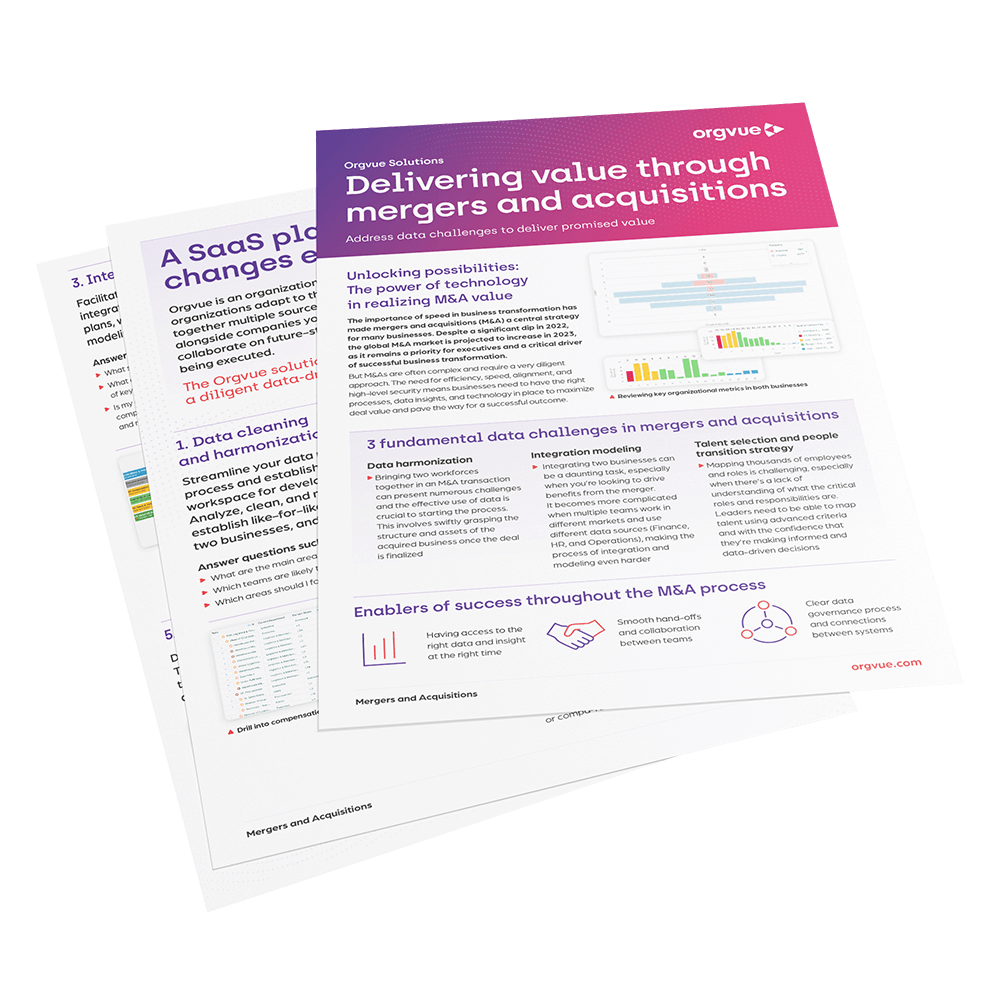

Solution brief

Delivering value through M&A

Read our latest solution brief and discover how Orgvue can help realize value through data-driven decision making.

Learn more about how we can help you:

- create a secure single source of harmonized data that can be accessed by multiple teams

- model org structures, and identify synergies using visualization and automation to address data inconsistencies

- map talent to your future organization, so planners can make informed decisions based on advanced criteria such as skills, financial planning, regulatory compliance, and the desire for hybrid working.

More resources

Book your free demo

Design your business of tomorrow, today. Discover what Orgvue can do for your organization first-hand.